According to PwC’s 2025 CEO Survey, 40% of CEOs believe their companies won’t survive the next decade unless they reinvent their business models. For many, it’s much easier, faster, and cheaper to reinvent through mergers and acquisitions (M&A) than to develop a business organically, especially when M&A aligns with broader strategic objectives.

But what is a merger and acquisition, really? At its core, M&A is when companies combine to accelerate growth, gain capabilities, or enter new markets. However, choosing a successful M&A direction is no easy task. This article explains why, when, and whom to acquire.

You will get answers to the following questions:

- Which of the M&A strategies aligns with your strategic goals?

- What is the best M&A strategy in 2025?

- Which practices lead to a successful M&A strategy?

Choose your direction: The 6 M&A strategy archetypes

Choosing the right direction depends on your company’s strategic intent, whether it’s business scale, supply chain control, geographic expansion, product diversification, or risk hedging. Below, we break down the most widely used M&A strategy archetypes, outlining when to use each, their benefits and limitations, metrics to watch, and real-world case studies.

Horizontal M&A

In a horizontal M&A strategy, an acquiring firm buys similar companies that sell similar products and operate in the same market. These two companies often compete directly, and the goal of the deal is to eliminate competition.

Best when: The industry is mature or consolidating, and competitive advantage depends on gaining scale to lower costs, expand market share, or improve pricing power.

Benefits of horizontal M&A:

- Operational synergies through shared research and development (R&D), facilities, and marketing

- Revenue growth from broader product lines and customer reach

- Stronger market power via scale and supplier leverage

Risks and limitations of horizontal M&A:

- Regulatory scrutiny if market share exceeds regulatory thresholds

- Added complexity may slow decisions and increase overhead

- Cultural integration risks and disrupted operations

Note: A merged company may trigger a review by the Competition and Markets Authority (CMA) if the deal creates a 25% market share or involves a target with over £70 million in UK turnover.

Metrics to watch:

- Synergy realisation rate (% of projected savings achieved)

- Post-merger EBITDA margin or revenue growth

- Time to regulatory clearance

- Customer churn or retention in overlapping markets

Case study: ExxonMobil–Pioneer (2024)

In May 2024, ExxonMobil completed its $60 billion acquisition of Pioneer Natural Resources, creating the largest unconventional oil and gas operator in the Permian Basin. The horizontal deal doubled Exxon’s footprint to 1.4 million acres and added approximately 16 billion barrels in recoverable resources.

Exxon aims to boost Permian output from 1.3 million to 2 million barrels per day by 2027, leveraging scale, proprietary technology, and ESG alignment to drive double-digit returns.

Vertical M&A strategy

In a vertical M&A strategy, the acquiring firm targets companies operating at different stages of the same supply chain, typically upstream suppliers or downstream distributors.

Best when: A company’s profitability or service quality depends heavily on supply chain stability.

Benefits of vertical M&A:

- Greater supply chain control and reduced third-party reliance

- Lower costs via streamlined logistics

- Improved quality and consistency through direct oversight

- New revenue streams and bundling opportunities

Risks and limitations of vertical M&A:

- Regulatory pushback if rivals lose input or channel access

- Complex operations across the value chain strain leadership

- Limited scale benefits compared to horizontal mergers

Metrics to watch:

- Input cost reduction over time (compared to pre-acquisition benchmarks)

- Supply reliability metrics (e.g., lead time, order fulfillment rate)

- Post-merger gross margin improvement

- ROI on vertical asset utilisation (e.g., capacity use of acquired facilities)

Case study: IKEA–Greengold Forest Acquisition (2015)

In a strategic vertical move, IKEA acquired 33,600 acres of forest in Romania from Greengold Group for $62 million. The goal was to secure long-term access to timber, its most critical raw material, and reduce exposure to volatile lumber markets.

This upstream acquisition gave IKEA greater control over supply costs, improved local profitability, and supported its sustainability agenda. By internalising part of its wood sourcing, IKEA cut out intermediaries, stabilised production margins, and reinforced ESG credentials.

Between 2020 and 2022, IKEA’s Romanian operations nearly quadrupled profits, with earlier years already showing double-digit sales growth tied to this vertically integrated model.

Concentric M&A strategy

A concentric M&A strategy involves acquiring a business that operates in a related industry or adjacent market. While the target business may offer different products or services, its customer base, distribution channels, or core capabilities often overlap with the acquirer’s.

Best when: A company seeks growth through diversification but wants to stay close to its core markets, leveraging existing relationships, infrastructure, or capabilities to accelerate entry into adjacent segments.

Benefits of concentric M&A:

- Access to complementary tech, talent, and capabilities

- Diversification into adjacent markets without overreach

- Bundled offerings that deepen customer relationships

Risks and limitations of concentric M&A:

- Strategic drift that weakens core business focus

- Integration challenges from mismatched models or cultures

Metrics to watch:

- Customer overlap/conversion rate

- Cross-sell revenue contribution

- Post-merger operating margin vs. baseline

- Time-to-market acceleration for combined offerings

Case study: Coca-Cola–Costa Limited (2019)

In 2019, Coca-Cola acquired Costa Coffee, a British coffeehouse chain, for $4.9 billion, entering the global coffee market with an adjacent, fast-growing category. The deal added over 20 million customers, a broad retail footprint, and Costa Express machines.

Coca-Cola later launched Coca-Cola Coffee in 25 markets, using Costa to expand out-of-home channels, diversify its portfolio, and tap cross-selling and product innovation opportunities in the competitive beverage sector.

Conglomerate M&A: Unrelated diversification

In conglomerate mergers and acquisitions, an acquiring company buys a target company operating in an entirely unrelated industry. The two companies usually don’t share similarities in business operations and often operate in different markets.

Best when: A company seeks to hedge against sector-specific risks or macroeconomic cycles by investing in unrelated, cash-generating businesses with stable long-term fundamentals.

Benefits of conglomerate M&A:

- Diversified revenue reduces exposure to sector downturns

- Flexible capital allocation across business units

- Lower volatility through acquired assets with multi-industry cash flow streams

Risks and limitations of conglomerate M&A:

- Complex oversight and stretched leadership bandwidth

- Strategic focus diluted across unrelated sectors

- Poor fit can lead to weak integration and low returns

Metrics to watch:

- Group-level return on invested capital (ROIC)

- Cash flow contribution by segment

- Capital efficiency across unrelated units

- Conglomerate discount (valuation gap vs. sum-of-parts)

Note: Conglomerate M&A can be classified as pure or mixed. While pure conglomerate mergers between firms with no operational, customer, or market overlap are rare, mixed conglomerates often blur the lines between horizontal, vertical, and concentric merger and acquisition strategies.

Case study: Berkshire Hathaway–Dairy Queen (1997)

In 1997, Berkshire Hathaway acquired fast-food franchisor Dairy Queen for $585 million, marking a classic conglomerate M&A move. Dairy Queen’s franchise model (operating as a separate company) offered stable cash flows, global scale, and low capital intensity.

The deal aligned with Berkshire’s strategy of owning independently run, profitable businesses across diverse sectors, from insurance to fast food, to reduce exposure to industry-specific volatility and smooth group-level performance.

Market expansion M&A: Expanding reach

A market extension merger occurs when an acquiring company purchases another firm in the same industry but operating in a different geographic market.

Best when: A company has a proven business model in one region and seeks faster expansion into new territories by acquiring local players with established market presence and customer trust.

Benefits of market extension M&A:

- Faster geographic growth than greenfield entry

- Immediate access to customers, brands, and distribution

- Shared infrastructure and marketing reduce costs

- Potential early-mover advantage over competitors

Risks and limitations of market extension M&A:

- Cultural and legal differences complicate execution

- Fewer cost synergies than horizontal deals

- Integration issues across systems and leadership

- Market success may not transfer across regions

Metrics to watch:

- Time to market launch in a new geography

- Market share gains vs. local incumbents

- Customer acquisition cost (CAC) in the new region

- Revenue contribution from new territories

- Retention and brand adoption in newly acquired markets

Case study: Lyft–Freenow (2025)

In 2025, US-based ride-hailing company Lyft acquired Freenow, a leading European mobility platform, for approximately €175 million. The market-extension deal gave Lyft access to over 150 cities across nine countries, nearly doubling its addressable market.

Freenow’s local networks and regulatory ties strengthened Lyft’s position in Europe, while the brand continued operating independently. The move expanded Lyft’s geographic footprint within the ride-hailing sector without diversifying into unrelated businesses.

Product extension M&A: Expanding offerings

A product extension merger occurs when a company acquires another firm in the same industry and geographic market, but offering a different product or service.

Best when: A company has strong customer relationships and market reach, and wants to increase wallet share by offering a broader set of solutions to the same buyers.

Benefits of product extension M&A:

- Diversifies revenue by adding complementary offerings

- Enables cross-selling to existing customers

- Increases retention through bundled solutions

- Reduces costs via shared sales and support

Risks and limitations of product extension M&A:

- Risk of brand confusion or dilution

- Channel conflict from overlapping sales routes

- Integration hurdles across teams and pricing models

- Weak customer adoption if the fit is misjudged

Metrics to watch:

- Cross-sell and upsell revenue contribution

- Product attach rates within the existing customer base

- Customer churn or retention post-integration

- Average revenue per customer (ARPC) uplift

- Gross margin performance of newly integrated product lines

Case study: Modine–L.B. White (2025)

In 2025, U.S.-based HVAC solutions leader Modine acquired L.B. White, a specialist in portable and agricultural heating, for approximately $112 million. The acquisition added complementary technologies for the construction and livestock sectors, aligning with Modine’s thermal management focus.

L.B. White’s strong North American presence and projected $73.5 million in annual revenue created cross-selling potential and allowed Modine to grow in adjacent, mission-critical markets without diluting its core capabilities.

Approaches to dealmaking: Which produces superior TRS?

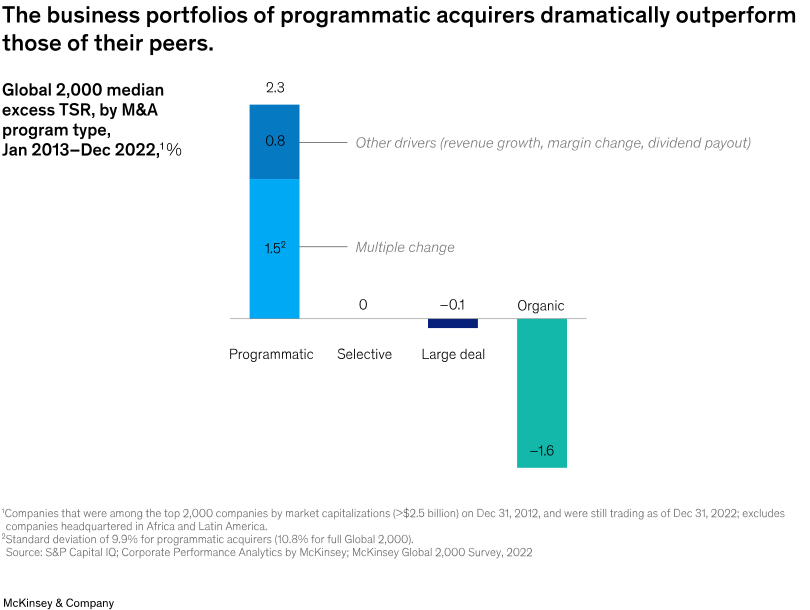

M&A approaches play a crucial role in post-deal outcomes. If executed incorrectly, they may neutralize the positive effects of a well-executed acquisition strategy, proven in empirical research on thousands of mergers and acquisitions. McKinsey’s empirical research identifies several types of acquisition:

- Programmatic (Frequent, strategic small-to-mid-sized deals)

- Selective (occasional, opportunistic deals)

- Large-deal (infrequent, transformational bets)

- Organic growth (internal expansion only)

Among them, programmatic M&A outperforms. Companies that execute multiple, well-aligned deals over time consistently achieve higher long-term total shareholder returns (TRS).

They reallocate capital more effectively, enter new markets earlier, and generate more consistent value than peers relying on one-off acquisitions or organic growth alone. This approach resembles what private equity firms do when building platform investments — executing multiple bolt-on acquisitions to scale efficiently, extract synergies, and enhance portfolio value over time.

Source: McKinsey: What Programmatic Acquirers Do Differently

2025 dealmaking context: What changed since 2023

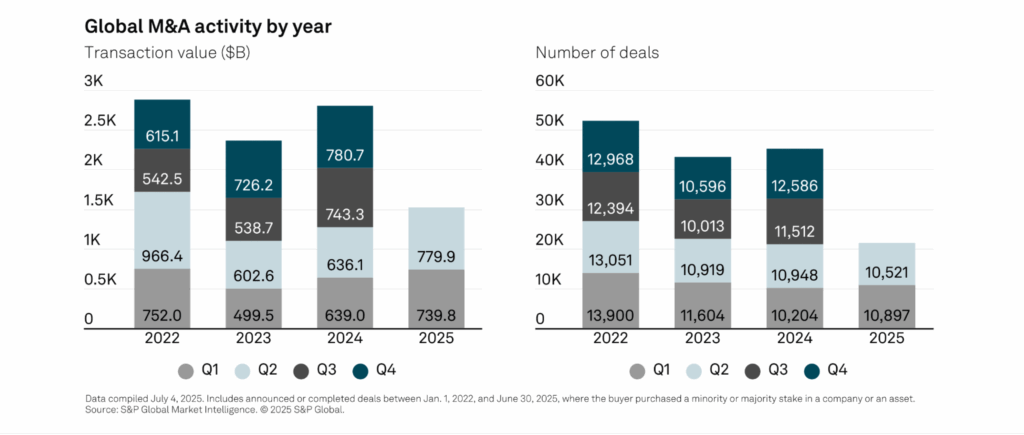

Global M&A activity has rebounded after a subdued 2023, with dealmakers adjusting to new macro dynamics, including higher financing costs, regulatory pressure, and changing consumer preferences. Here’s how industry reports define the landscape heading into late 2025:

Global trends

- Deal value reached $780 billion in Q2 2025, the third-highest quarterly total in four years — up 23% year-over-year, despite a 3.5% decline in deal count.

- April 2025 saw the steepest month-over-month drop since Jan 2023 (due to US trade policy shifts), but markets quickly recovered.

- Larger transactions are dominating, with 14 deals over $10 billion contributing to the quarter’s sharp value spike.

- Deal count remains below pre-2022 levels, but average deal size continues to climb.

Source: S&P Global: Global M&A by the Numbers: Q2 2025

Sector highlights

- Industrials led all sectors with $135 billion in deal value — its strongest quarter since Q4 2022.

- Information Technology rose +27% YoY to $97 billion, driven by cloud and infrastructure deals, though average multiples fell to 18.9x, down from 27.2x in 2022.

- Financials posted strong activity, led by the $17 billion Worldpay–Global Payments transaction and follow-on divestitures.

Private equity dynamics

- Dry powder remains elevated, but deployment is measured. Quality and cash flow stability now matter more than scale.

- Exit activity is recovering, though still below peak years. Dealmakers are focusing on carve-outs and add-ons.

- Firms are increasingly aligning deal theses to margin resiliency, tech integration, and sector defensibility.

How to build your mergers and acquisitions strategy?

From identifying strategic gaps to choosing the right approach, each decision should be grounded in a clear value creation logic and operational readiness. These steps offer a structured framework to guide your M&A playbook.

Understand corporate strategy gaps

Understand which M&A direction to choose based on your strategic goals and gaps in your business capabilities. Thus, concentric M&A addresses product gaps and market adjacency needs, while vertical M&A typically strengthens the supply chain.

Select your M&A approach

Assess your internal M&A maturity, integration capacity, and strategic urgency to decide whether a programmatic model better suits your growth objectives. Companies with high integration readiness and disciplined capital reallocation are better positioned to scale programmatic M&A into a repeatable growth engine.

Targeting thesis & pipeline

Develop a clear M&A thesis based on 3–5 strategic themes, not a broad shopping list of potential targets. Focus on solving specific problems, such as entering adjacent markets, acquiring enabling tech, or consolidating fragmented segments.

Build a dynamic pipeline that aligns with your value creation goals, capital capacity, and integration resources. For example, the company may limit itself to three acquisitions per year, each valued at no more than £100 million, to stay within capital allocation and integration bandwidth constraints.

Evaluate your value creation model

Establish several business improvement directions and identify potential opportunities within a deal. Unveil and review any financial limitations on the deal value, quantity, and post-merger performance expectations.

Develop an integration plan

Determine operational interventions and resources required to integrate acquisition targets. For instance, a few new facilities are required to absorb target A, while a new business department is needed for target B.

Tooling up: VDRs and workflow software that actually help

Use dedicated M&A software solutions, such as virtual data rooms (VDRs), to collaborate with sellers smoothly and seamlessly. VDRs provide the following benefits to the deal process:

- Ironclad security. Leverage zero-trust security to protect yourself from data compliance concerns, unsolicited file sharing, agreement violations, and data breaches. Advanced options, such as IRM-encrypted files and fence view permissions, prevent unauthorised access, copying, or screenshotting even offline.

- Fast due diligence. Establish M&A workflows to manage high data flows between the companies involved in due diligence. With integrated tools, such as AI-powered search, audit trails, and Q&A workflows, teams accelerate document review and maintain full traceability throughout the process.

- Convenient governance. Use role-based content rights to facilitate collaboration between senior management and execution teams. Granular permission levels and document versioning ensure that only the right users see the right documents.

FAQ

What is the difference between M&A strategy and corporate strategy?

Corporate strategy defines long-term business goals and competitive positioning, while M&A strategy outlines how acquisitions or divestitures support those goals. The latter is a tool for executing the former.

What’s the best M&A strategy in 2025?

There’s no one-size-fits-all answer, but programmatic M&A continues to outperform selective or large-deal approaches in total shareholder return. The right strategy depends on your industry dynamics, deal capability, and capital discipline.

How do regulators evaluate a merger?

Regulators assess mergers based on market concentration, competitive impact, and consumer harm, particularly in horizontal deals. In the UK, the Competition and Markets Authority (CMA) leads this review.

Horizontal, vertical, or conglomerate — which fits best?

It depends on your strategic gap. Use horizontal for market share, vertical for supply control, and conglomerate for diversification. Your integration capacity and risk tolerance should guide the choice.

How do I estimate revenue synergies credibly?

Start with a bottom-up forecast. Model new cross-sell opportunities, upsell potential, or geographic expansion by customer segment. Validate assumptions with pilot data, customer analytics, and comparable post-merger benchmarks.