The pressure to do due diligence faster and better is ramping up, as a lack of proper due diligence can derail the deal. That’s exactly why more and more teams here in the UK are turning to due diligence software now. Here are our key findings of some of the best due diligence software solutions across categories like VDRs, KYC, TPRM, and more.

What due diligence software does and when you need it

Due diligence software is a tool that helps you investigate and verify a company’s information before you buy or invest in it. The right due diligence software helps teams conduct accurate reviews and manage everything they need before making a serious business decision. When all the checks and files are organized, work moves faster, and there’s less room for human errors.

This software is getting popular as the mergers and acquisitions market is expected to grow. In fact, Q3 of 2025 saw a 26.8% rise in deal value. Moreover, a recent Deloitte survey shows a positive sentiment towards deal dynamics in 2026. 90% of PE respondents and 80% of corporate respondents said they expect an increase in deal numbers in the next year.

Virtual Data Rooms (VDR)

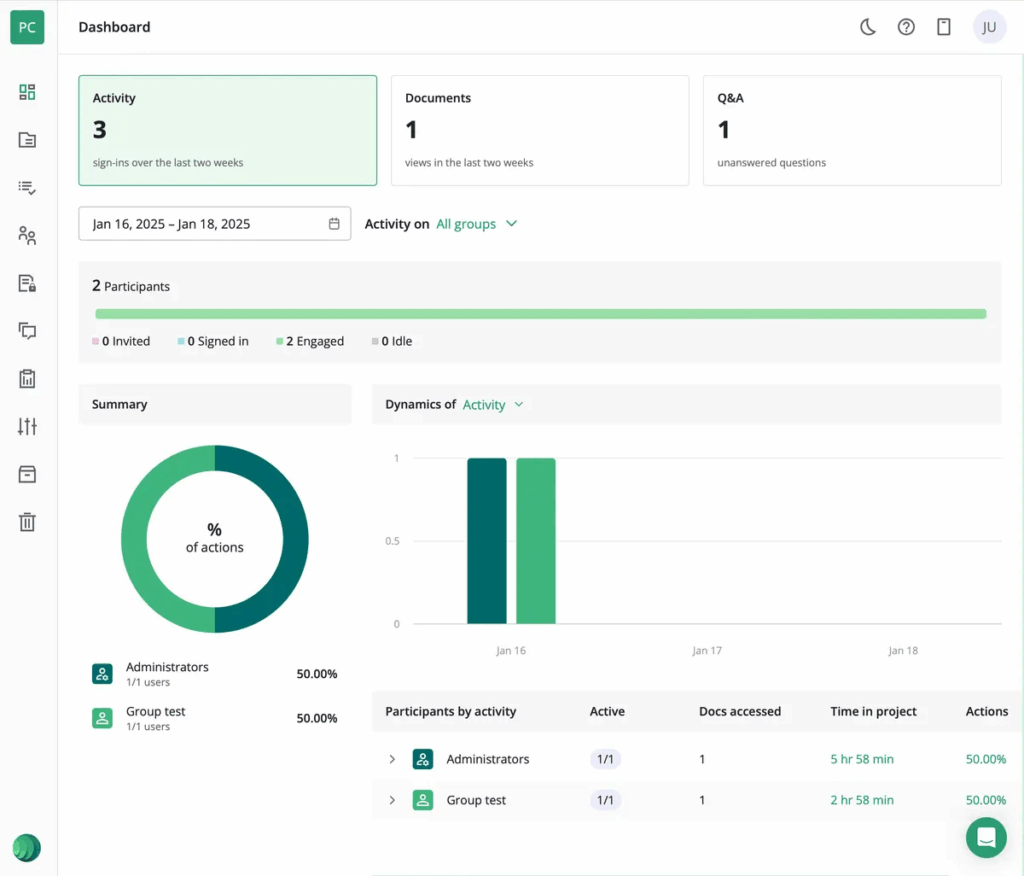

1. Ideals VDR

Website: idealsvdr.com

Best for: Small to large M&A transactions, due diligence, fundraising, and audits

Standout features:

- 24/7 multilingual customer support

- 8 levels of granular access permissions

- Built-in redaction and Fence View for screenshot protection

- Dynamic watermarks with IP address, username, and timestamp

- Auto-indexing and OCR for 25+ file formats

- Page-by-page activity tracking

- Windows Explorer integration via iDeals Sync app

- Two-factor authentication and remote shred

Where it falls short:

- Requires a custom quote

- Some users report higher costs compared to other cloud applications

Pricing snapshot:

- Three subscription tiers: Core, Premier, and Enterprise

- Custom pricing based on storage, users, and projects

- 30-day free trial with full functionality

- Accepts wire transfers, Visa, and Mastercard

Notable integrations:

- Microsoft 365 and Outlook

- Google Workspace, Gmail, and Google Drive

- Salesforce Sales Cloud

- GitHub

- QuickBooks Online

- FreshBooks

- Basecamp

- RightSignature

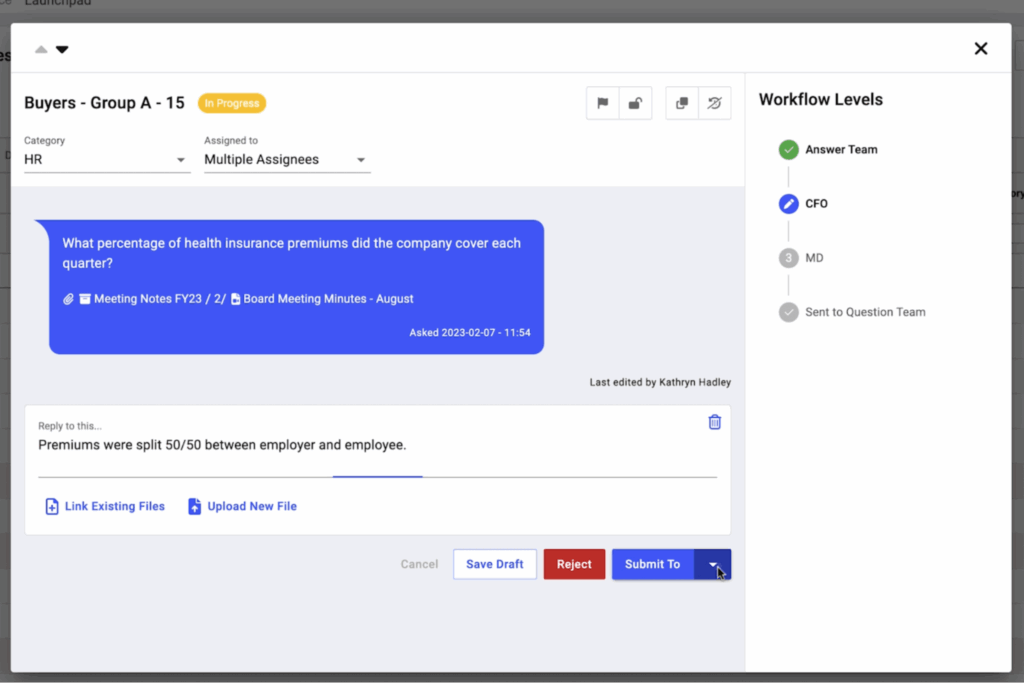

2. Datasite Diligence

Website: datasite.com

Best for: Enterprise-level M&A transactions

Standout features:

- AI-powered document redaction

- Multilingual full-text search

- Integrated Q&A section with customizable workflow and roles

- Drag-and-drop bulk upload supporting ZIP files up to 50 GB

- Advanced analytics dashboards

- Smart AI categories

Where it falls short:

- No free trial available (demo only upon request)

- Custom pricing can be expensive for smaller deals

- Steep learning curve for all features

Pricing snapshot:

- Custom pricing based on project complexity and size

- Typically tailored for enterprise deals

- Unlimited bidders, admins included in pricing

- Contact required for demo and pricing

Notable integrations:

- Limited public information on integrations

- Enterprise-grade security compliance (ISO 27001, SOC 2, GDPR)

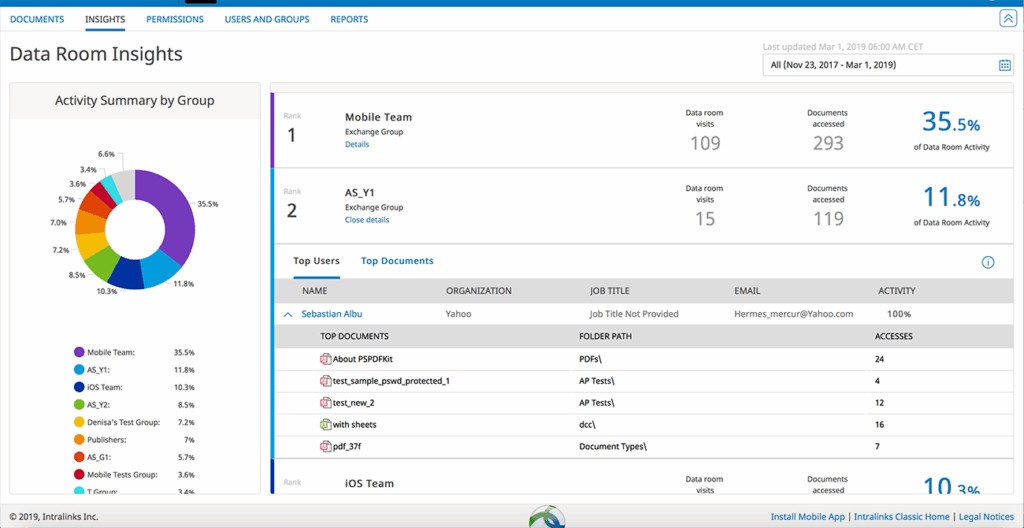

3. Intralinks VDRPro

Website: intralinks.com

Best for: Mid-market to enterprise M&A

Standout features:

- AI-powered due diligence tools

- Advanced Q&A functionality

- View As feature to preview access from different user perspectives

- Dynamic watermarks and IP address restrictions

- Deal marketing capabilities for both buyers and sellers

Where it falls short:

- Higher price point than competitors

- Can be complex to set up initially

- Some users report slower customer support response times

Pricing snapshot:

- Custom enterprise pricing

- Typically project-based or subscription models

Notable integrations:

- Microsoft Office 365

- Enterprise security systems

- Various CRM platforms

For more data room options, check out this data room listing.

Vendor Risk Management (TPRM)

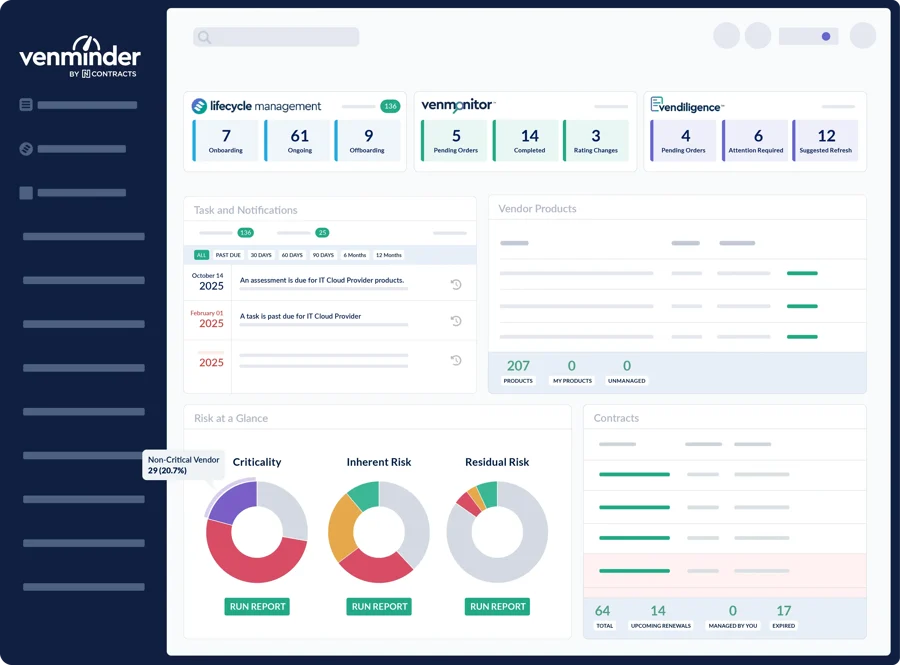

1. Venminder

Website: venminder.com

Best for: Financial institutions and regulated industries

Standout features:

- Expert-delivered risk assessments

- Venmonitor real-time risk intelligence across multiple risk domains

- Automated vendor lifecycle management

- Regulatory compliance tracking

- Document collection automation

Where it falls short:

- Primarily focused on the financial services sector

- Higher cost structure for smaller organizations

- May require significant onboarding time

- Less flexible for non-regulated industries

Pricing snapshot:

- Custom enterprise pricing based on vendor portfolio size

- Additional costs for expert assessment services

- Contact sales for detailed pricing

Notable integrations:

- Multiple compliance and GRC platforms

- Document management systems

- Workflow automation tools

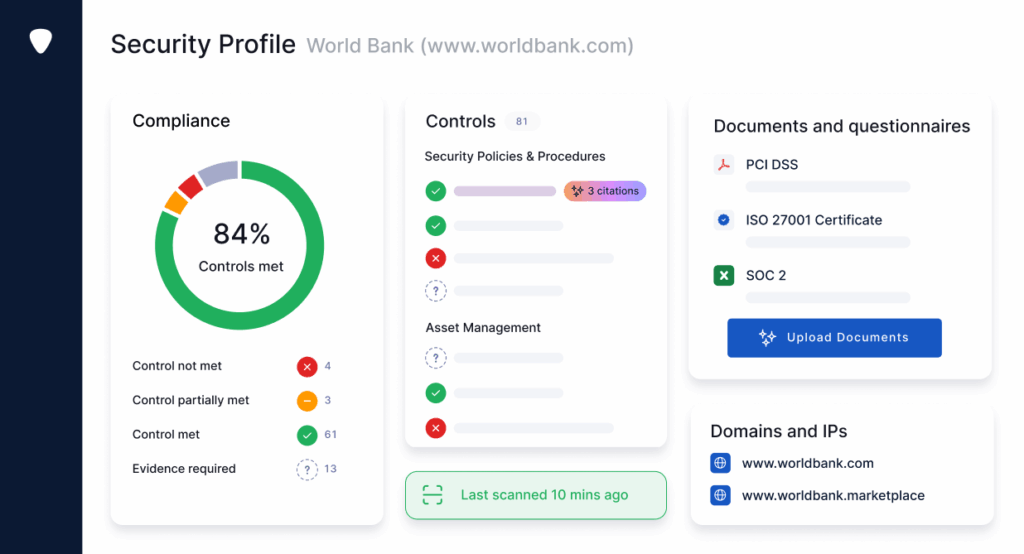

2. UpGuard

Website: upguard.com

Best for: Organizations needing security-focused TPRM

Standout features:

- Rapid onboarding

- Automated security ratings with continuous monitoring

- Board-ready PowerPoint exports for executive reporting

- Daily monitoring with real-time alerts for score drops

- Intuitive, user-friendly design

- Data leak detection capabilities

Where it falls short:

- Focus primarily on cybersecurity risk

- May lack depth in other risk domains (financial, ESG)

- Limited questionnaire customization compared to competitors

Pricing snapshot:

- Subscription-based pricing

- Custom quotes based on the number of vendors monitored

- Free demo available

Notable integrations:

- Jira, Slack, ServiceNow (native)

- 4,000+ apps via Zapier

- API and webhooks for custom integrations

- GRC, CRM, and ERP software

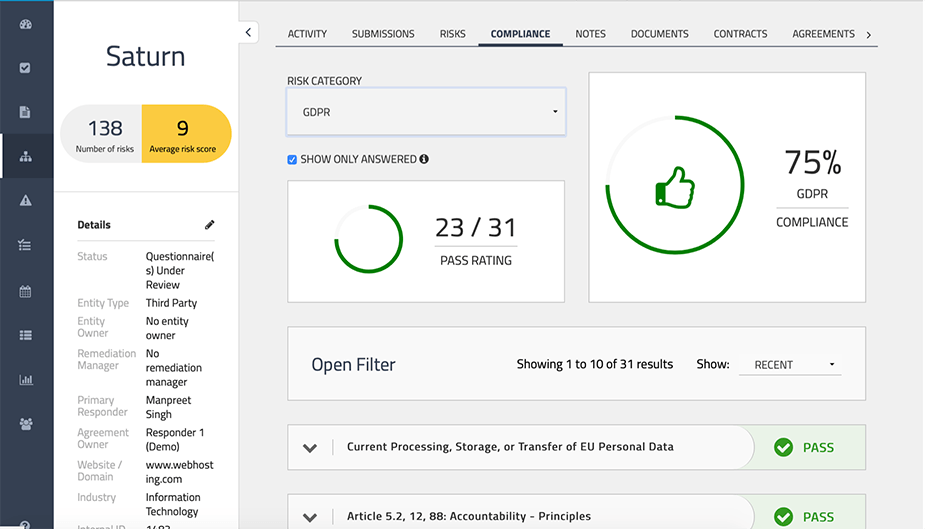

3. Prevalent (Mitratech)

Website: prevalent.net | mitratech.com

Best for: Organizations seeking comprehensive AI-powered TPRM with managed services

Standout features:

- AI-powered Auto Assessment Population

- Alfred virtual risk advisor

- Over 800 assessment templates with industry-standard questionnaires

- Access to thousands of completed, standardized risk reports

- Vendor Threat Monitor with deeper reputational risk insights

Where it falls short:

- UI can feel overwhelming with volume of information

- Limited reporting customization with some users reporting rigid dashboards

- Steeper learning curve for full platform capabilities

- Integration options still expanding

Pricing snapshot:

- Custom enterprise pricing based on vendor count and features

- Platform-only or with managed services add-ons

- Request demo for specific pricing

Notable integrations:

- ServiceNow, RSA Archer

- BitSight, SecurityScorecard (cyber risk data)

- ProcessUnity, OneTrust

- AWS infrastructure

- SSO via Okta, OneLogin, Auth0, Azure AD

KYC/AML and Adverse Media Screening

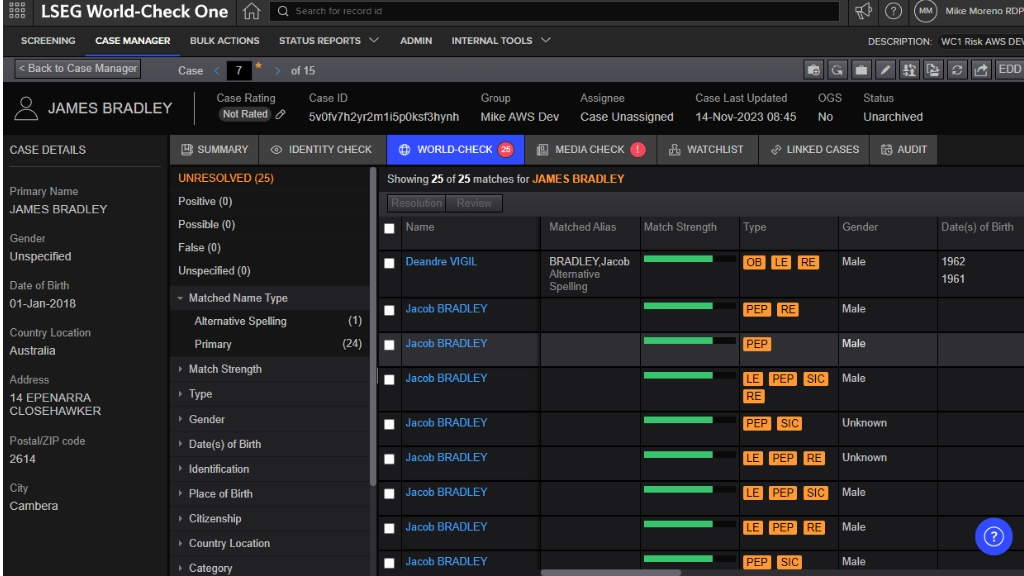

1. World-Check (LSEG)

Website: lseg.com

Best for: Large financial institutions

Standout features:

- World-Check On Demand API

- Structured, machine-readable data reducing false positives

- Real-time record updates

- Comprehensive coverage (sanctions, PEPs, adverse media, enforcement actions)

- Global regulatory compliance (FATF, EU AML, OFAC)

Where it falls short:

- Can be complex for smaller organizations

- Requires technical expertise for API integration

- Occasional false positives despite improvements

Pricing snapshot:

- Enterprise licensing model

- Custom pricing based on volume and features

- Contact sales for quotes

- Toll-free numbers available globally

Notable integrations:

- Major core banking systems

- Compliance and case management platforms

- Risk management systems

- API-first architecture for custom integrations

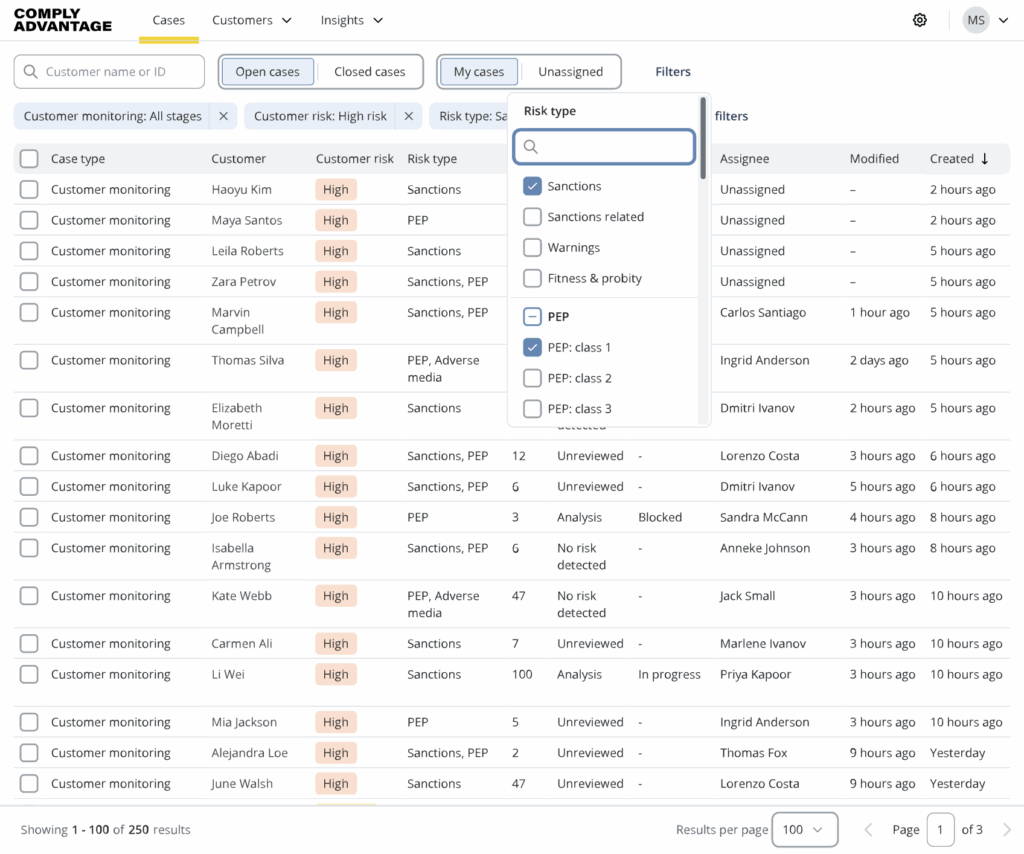

2. ComplyAdvantage

Website: complyadvantage.com

Best for: Fintechs and modern financial institutions

Standout features:

- Machine learning and AI for customer screening

- Real-time transaction monitoring

- Dynamic risk scoring adapting to threats

- Adverse media screening with AI-enhanced data

- Modern, API-first architecture

Where it falls short:

- Newer to market compared to legacy providers

- May lack some traditional banking integrations

- Pricing can be high for smaller fintechs

Pricing snapshot:

- Subscription-based SaaS model

- Custom pricing based on transaction volume

- Contact for demo and pricing

Notable integrations:

- Modern banking APIs

- Payment processing platforms

- Core banking systems

- Case management tools

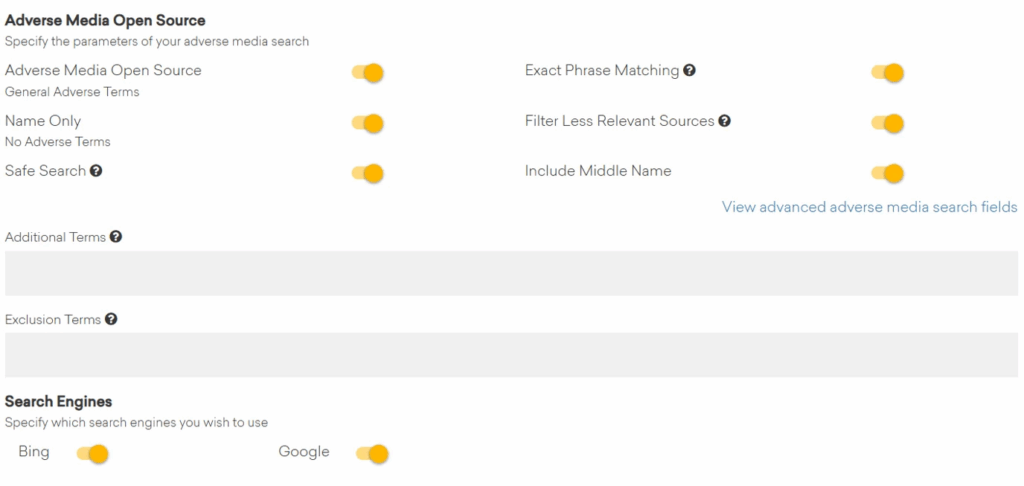

3. KYC360

Website: kyc360.com

Best for: Organizations requiring advanced screening accuracy with meta-data improvement and multiple data provider options

Standout features:

- 3D risk-based screening approach reducing false positives by two-thirds

- Meta-data improvement techniques increasing input data accuracy

- Data agnostic (choose between Dow Jones, World-Check, or Lexis Nexis)

- RiskScreen for ad-hoc searches with no user limits

- Batch screening handling tens of millions of names

- Adverse media monitoring with customizable criteria

Where it falls short:

- Interface may seem less modern than newer competitors

- Learning curve for advanced features

- Limited information on mobile capabilities

Pricing snapshot:

- Credit-based pricing for RiskScreen (ad-hoc)

- 1 credit for standard search, 10 for EDD

- Monthly or annual search credits

Notable integrations:

- Dow Jones, World-Check, Lexis Nexis data feeds

- API for custom integrations (REST/SOAP)

- Workflow and case management systems

Cybersecurity Ratings and Third-Party Attack Surface

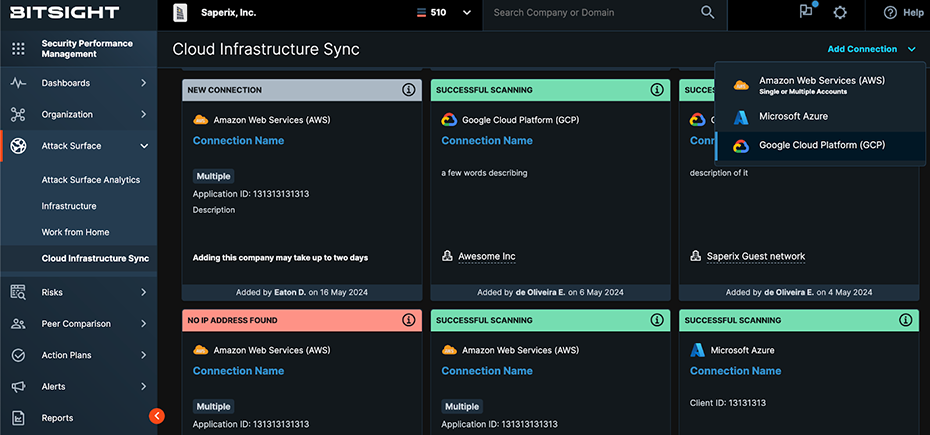

1. BitSight

Website: bitsight.com

Best for: Enterprises requiring comprehensive cyber risk intelligence

Standout features:

- Unified platform combining EASM, threat intelligence, and TPRM

- AI-powered telemetry and analytics for proactive threat identification

- Continuous asset monitoring with global threat insights

- 45% reduction in breach probability (Forrester TEI study)

- 75% reduction in third-party risk breaches

Where it falls short:

- Premium pricing tier

- Attribution challenges in shared environments

- Separate licensing for different modules increases complexity

- Steep learning curve for full platform

Pricing snapshot:

- Custom enterprise pricing

- Based on company size, number of vendors, and features

- Request demo for pricing information

- Typically annual contracts

Notable integrations:

- ServiceNow, JIRA, ProcessUnity, OneTrust

- SIEM/XDR tools for enriched threat detection

- GRC and risk management platforms

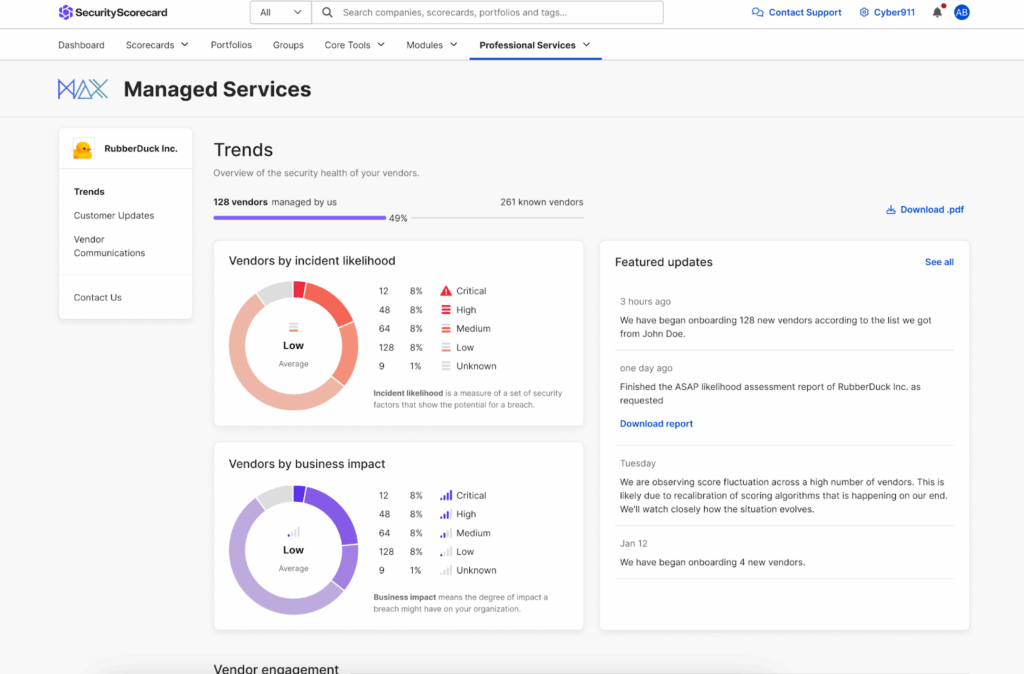

2. SecurityScorecard

Website: securityscorecard.com

Best for: Organizations needing actionable security ratings with strong vendor collaboration and remediation workflows

Standout features:

- Supply Chain Detection and Response (SCDR) connecting TPRM and SOC teams

- AI-powered analytics for proactive threat detection

- Active vendor engagement, not just passive monitoring

- External Attack Surface Management with shadow IT detection

- Single-pane-of-glass dashboard for comprehensive visibility

- Customizable reporting for board presentations

Where it falls short:

- Can be expensive for smaller vendor portfolios

- Some users report a learning curve for advanced features

- Occasional data accuracy issues requiring vendor collaboration

Pricing snapshot:

- Subscription-based model

- Pricing tiers based on a number of vendors monitored

- Custom enterprise pricing

- Request a demo for specific quotes

Notable integrations:

- SOC and SIEM platforms

- Ticketing systems (Jira, ServiceNow)

- GRC and risk management tools

- API for custom integrations

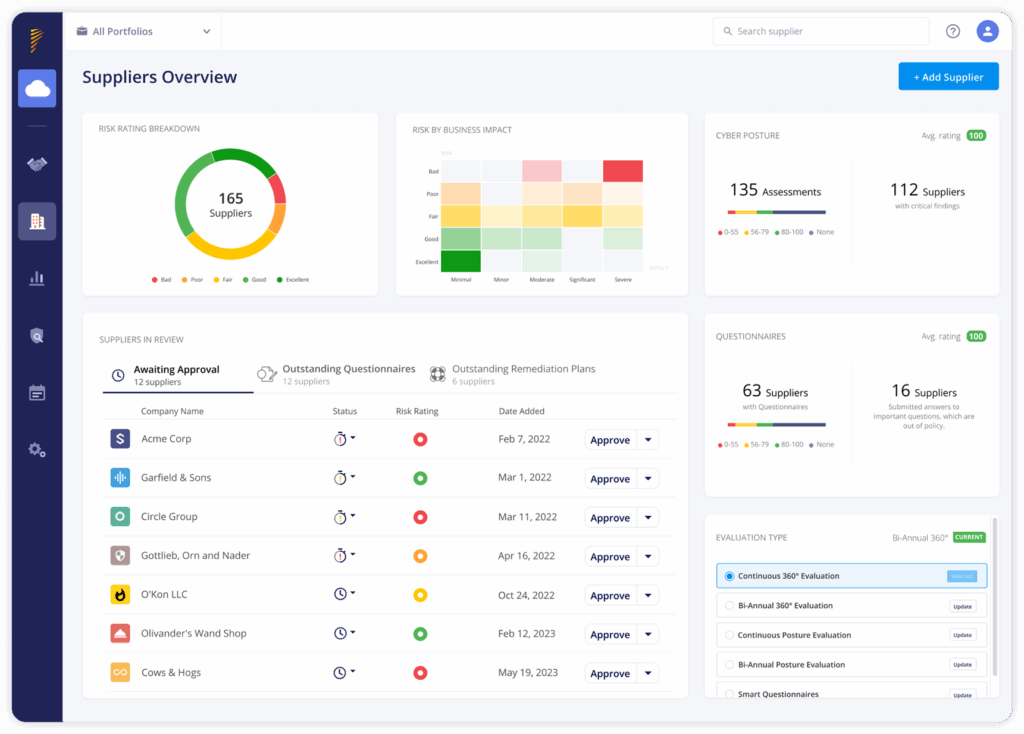

3. Panorays

Website: panorays.com

Best for: Organizations seeking AI-driven third-party cyber risk management

Standout features:

- Risk DNA assessments

- AI-powered Smart Questionnaires that auto-populate based on vendor context and past responses

- Cyber Posture Rating (0-100) completed within hours

- Supply Chain Detection discovering 3rd to Nth party relationships and Shadow IT

- Auto-generated remediation plans with a vendor collaboration portal

- Real-time alerts on security posture changes and vulnerabilities

Where it falls short:

- Complex pricing structure with multiple service tiers

- Limited API flexibility compared to competitors

- Some users report occasional data accuracy issues requiring vendor verification

Pricing snapshot:

- Multiple tiers

- Custom pricing based on vendor count and assessment types

- Free trial available

Notable integrations:

- ServiceNow, RSA Archer (native)

- Okta, OneLogin, Auth0, Azure AD (SSO)

- REST API with webhooks

ESG and Supply Chain Due Diligence

1. IntegrityNext

Website: integritynext.com

Best for: Companies needing comprehensive supply chain sustainability management

Standout features:

- 2M+ pre-verified suppliers across 190+ countries

- AI-powered Critical News Monitoring scanning 1B+ daily messages

- Multi-tier supply chain visibility down to the raw material level

- Automated compliance for CSDDD, LkSG, CSRD, EUDR, CBAM

- Carbon emissions tracking with Scope 1, 2, 3 calculations

- Supplier surveys in 14 languages for easy data collection

- 5-step due diligence framework validated by legal opinion

Where it falls short:

- Can be complex for smaller supply chains

- Requires supplier engagement and participation

- Premium pricing for enterprise features

- Learning curve for full platform capabilities

Pricing snapshot:

- Custom enterprise pricing

- Based on supplier count and features

- Annual subscription model

- Request a demo for pricing

Notable integrations:

- SAP Ariba (Extended API)

- ERP and SRM systems

- Procurement management platforms

- Custom integrations available

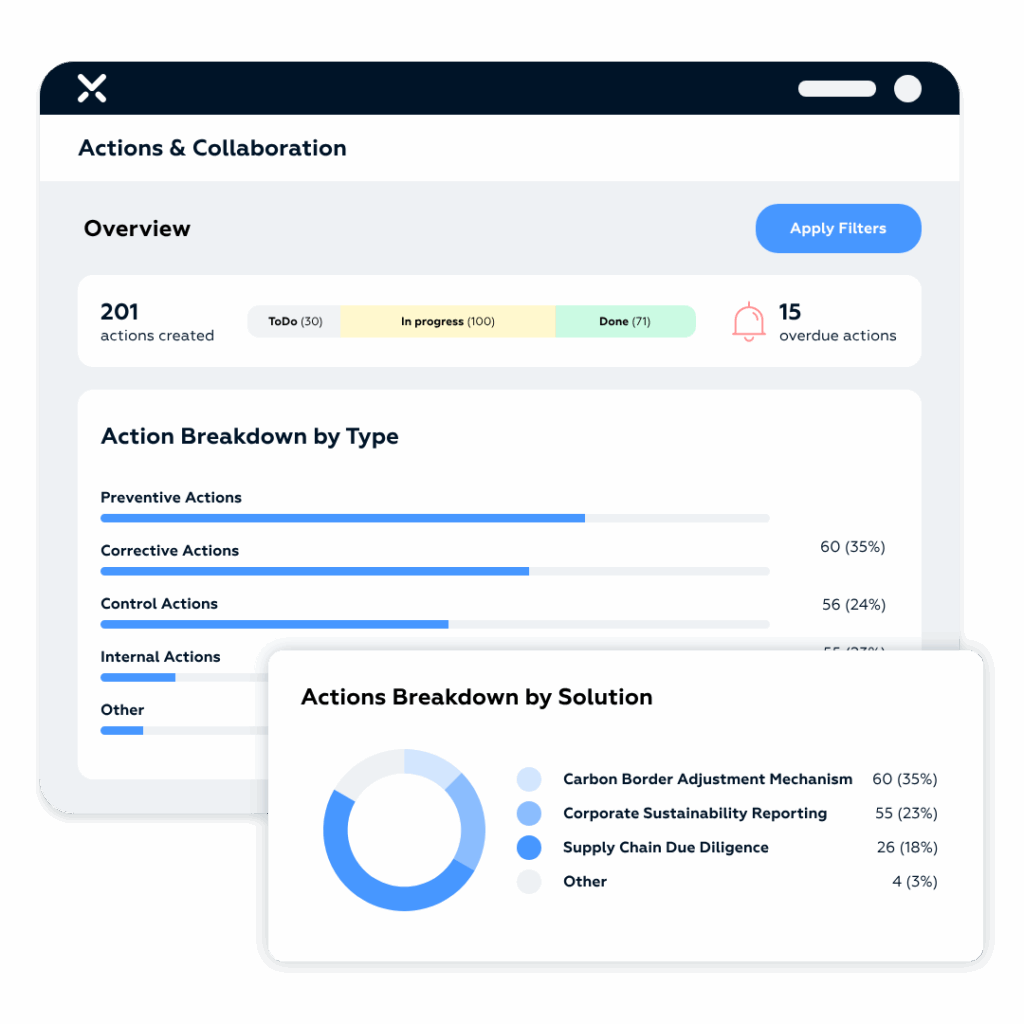

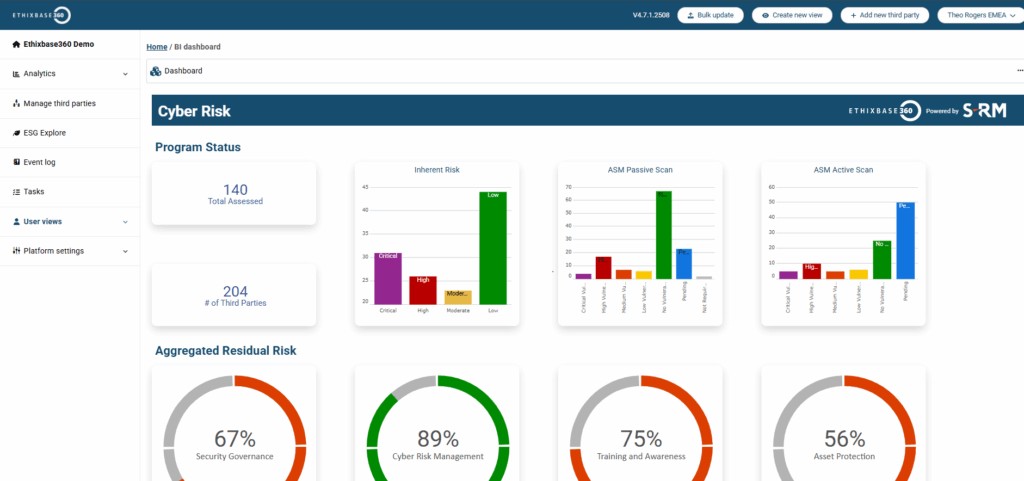

2. Ethixbase360

Website: ethixbase360.com

Best for: Organizations requiring comprehensive ESG risk assessment with Enhanced Due Diligence (EDD) reports across multiple languages

Standout features:

- ESG Explore Supply Chain Report for rapid baseline assessment

- Enhanced Due Diligence reports available in 35 in-house languages

- Research operations in 7 countries for global coverage

- Explore, Enhance, Engage methodology

- Anti-bribery, corruption, and modern slavery screening

- Collaborative due diligence with structured engagement

- Focus on human rights and environmental compliance

Where it falls short:

- Smaller platform compared to IntegrityNext

- Less automation in some areas

- Limited public information on pricing transparency

- May require more manual processes

Pricing snapshot:

- Custom enterprise pricing

- Based on a number of suppliers and services

- EDD reports available separately

- Contact for detailed pricing

Notable integrations:

- Procurement systems

- Compliance and risk platforms

- Custom integration options available

Mistakes to avoid

Even the top-rated software won’t benefit the business if the processes underneath it aren’t solid and efficient. These are the common challenges to avoid when selecting software for better due diligence:

1. Choosing features over data quality and coverage

It’s tempting to pick the platform with the longest feature list, but that’s often a mistake. What really matters is whether the underlying data is current and complete. This is especially critical for KYC and AML tools as businesses need comprehensive coverage of sanctions lists, adverse media, and corporate registries. A beautiful dashboard means nothing if it’s showing you outdated information.

2. Treating due diligence as a one-time event vs continuous monitoring

Risk isn’t static. Your vendors evolve, your customers’ situations change, and the regulatory landscape evolves. Your due diligence software needs to support ongoing monitoring rather than just initial screening.

3. Underestimating change management and training

The software is only as effective as the people using it. Many programs fail because teams don’t understand the workflows or find workarounds because they weren’t properly trained. Build comprehensive training into your rollout plan and make sure everyone understands not just the how, but the why behind each step.

4. Overcomplicating risk scoring without governance

Automated risk scoring should make your life easier, not harder. But when organizations layer on complex rules without clear ownership or documentation, the system becomes a black box. Keep your scoring logic transparent and maintainable. If your team can’t explain why something got flagged, your governance model needs work.

5. Ignoring evidence retention and auditability

Can you prove what checks you performed and when? If regulators or auditors ask for documentation from last year, can you produce it quickly? Your software needs robust audit trails, version control, and secure evidence storage. Without these, you’re building on sand, and no matter how thorough your current process feels.

If you want to dig deeper into building a solid framework, the VC due diligence checklist is worth exploring, it covers a lot of these fundamentals in more detail.

FAQs

How long does it typically take to implement due diligence software?

It depends on your organization’s complexity, but expect 2-6 months for a solid implementation. That includes data migration, workflow configuration, integration with existing systems, and training.

How much does due diligence software cost?

Pricing varies. Virtual data rooms often use project-based pricing, while KYC and AML tools follow usage-based models. Enterprise TPRM tools and AI due diligence software usually use annual subscriptions.

How do we measure due diligence software efficiency?

Start with baseline metrics before implementation: How long does vendor approval take? What percentage of your vendors have current documentation? How many hours go into each M&A deal? Then track the same metrics quarterly after rollout.

Also monitor user adoption rates. If people are working around the system, something’s wrong. The best indicators are often qualitative too: Are auditors satisfied? Do deal teams feel more confident? Has your risk committee noticed better insights? If the answer is Yes, the software was a good choice.