Before the mid-2000s, businesses used physical data rooms — secure physical spaces filled with paper documents — to share confidential information during deals and audits. Today, with the rise of cloud computing, the rule of thumb is to keep all confidential documents online, as it is more convenient, safer, and cheaper. This is when virtual data rooms (VDRs) come into play, offering a secure space for efficient document management.

These digital solutions streamline due diligence, M&A transactions, initial public offerings, fundraising, and legal processes. Sharing confidential data within VDR ensures top-tier security and compliance with regulations. Here, we explore what VDRs are, their key features, and how to choose a secure virtual data room for document sharing.

What is a virtual data room?

A virtual data room is a secure online data storage that provides controlled access, advanced security, and collaboration tools. It is an essential instrument for financial, legal, and corporate transactions. Online data rooms are used during financial transactions, legal proceedings, or business partnerships.

Virtual data rooms are now used more often than physical ones because they are more convenient and cater to modern business needs. Since the number of M&A deals is rising, organizations need consulting, advisory, and training services more than before. These services facilitate the effective deployment and use of virtual data room solutions to provide compliance with regulatory standards and enhance data security.

Another critical advantage of virtual solutions is that, unlike traditional data rooms, VDRs allow multiple users to access critical files anytime and anywhere without compromising data security. This detailed comparison guide dives further into how VDRs compare to the old-school physical data rooms.

Who uses data rooms

Data room market report from Fortune Business Insights highlights that the key end users of virtual data rooms are:

- Corporate development teams use them during partnerships, IPO preparations, and strategic reviews.

- Startups and growing businesses need VDRs when raising funds and needing to share business plans, financials, and IP with investors.

- Investment bankers and financial advisors who manage deal documentation during mergers and acquisitions (M&A) and capital raises need data rooms as well.

- Legal teams require data rooms for secure environments for case materials, litigation, and contract negotiations.

- Private equity and venture capital firms use VDRs to assess company data during due diligence before making investment decisions.

Key features of a data room

Here are some of the top data room features that make VDRs essential tools for complex business transactions:

- Access controls – set granular permissions for users and groups.

- Audit logs – track who accessed documents, when, and for how long.

- Document indexing and search – quickly locate files with advanced filters.

- Watermarking & digital rights management (DRM) – prevent unauthorized sharing of sensitive content.

- User activity analytics – monitor engagement and flag suspicious behavior.

- Collaboration tools – commenting, Q&A modules, and version control for seamless teamwork.

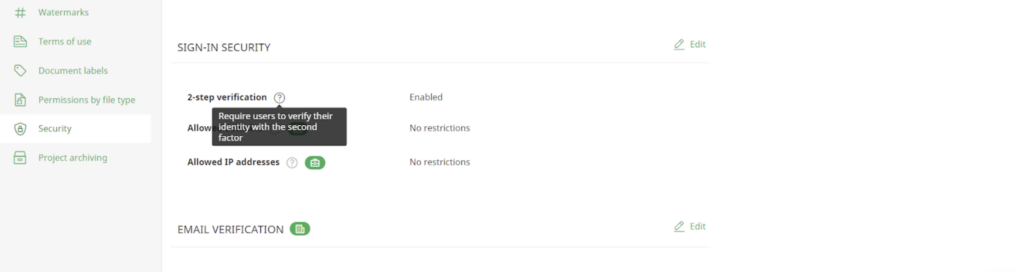

- Multi-factor authentication (MFA) – drastically reduces the likelihood of account takeover.

- IP address restrictions limit internet access to the data room to specific network addresses, such as those of known corporate devices.

- Customization & branding – personalize the interface with logos, colors, and custom domains for a professional appearance.

- Support & supportive features – get assistance during setup, pre-due diligence checks, and support for digitizing physical documents.

Are data rooms secure?

The short answer is Yes, they are. The long answer is that most of the data rooms on the market have a set of security features like encryption, dynamic watermarks, granular user permission, etc, to provide their users with a safe place for storing and sharing their highly sensitive data.

The Deloitte M&A market report, for example, underscores the need for a secure place during the due diligence process. They state that every stage of M&A strategy, such as screening, due diligence, transaction execution, and integration is subject to cyber threats and attacks which could harm both the acquirer and the target company. In this realm, a virtual data room must provide advanced security features to reduce potential cybersecurity risks prior to and after the deal closes. These essential security measures include:

- Multi-factor authentication (MFA)

- Granular permission settings

- Role-based access

- Real-time activity monitoring

- Compliance with standards like ISO 27001, SOC 2, GDPR

- Watermarking

- User security impersonation (“View as another user”)

- Scheduled activity reports

- Document redaction

- Secure in-platform communication (Q&A, comments, task workflows)

- Information Rights Management (IRM) security

- Multi-layered encryption (256-bit at rest and in transit)

- Redundant infrastructure and disaster recovery

- RAM-based data storage

Security features might differ depending on the VDR provider. Hence, users should always assess each platform’s certifications and security track record. This information can be found on a VDR provider’s website, usually under a dedicated Security or Compliance section. These pages highlight things like encryption, access controls, and data certifications. For a helpful overview, check out this VDR security guide.

How to choose a data room

When evaluating virtual data rooms, consider the following aspects:

Ease of use:

- Intuitive interface for non-technical users (e.g., drag-and-drop uploads).

- Mobile-friendly access for on-the-go review.

- Minimal training required for adoption.

Security features:

- Certifications (SOC 2, ISO 27001) and compliance with industry regulations.

- Data encryption in transit and at rest.

- Penetration testing and third-party security audits.

Scalability:

- Support for large datasets (100,000+ files) without performance lag.

- Flexible user licensing for growing teams or deals.

- Global access with localized data centers for speed.

Customization capabilities:

- White-labeling options (custom logos, colors) for branding.

- Tailored permission tiers (e.g., “View Only” for investors).

- Customizable NDAs and login portals.

Customer support:

- 24/7 live support with dedicated account managers.

- Multilingual assistance for international deals.

- Onboarding assistance and training resources.

Cost transparency

- Clear pricing (per-page, per-user, or flat-fee models).

- No hidden fees for storage, users, or support.

- Free trials or demos to test functionality.

Reputation & real reviews

- Industry-specific experience (e.g., M&A, biotech, real estate).

- Case studies or client testimonials.

- Independent reviews (G2, Capterra).

How do you set up and administer a data room?

Setting up a virtual data room (VDR) might sound like a technical task, but done right, it can make or break the efficiency of your deal process. As Justin Tinker, Marketing and Business Development Director at Imprima Group, explains, today’s VDRs are much more than digital filing cabinets. They’ve become the central hub for managing M&A transactions, offering secure access, advanced permissions, and a structure for both buyers and sellers to collaborate.

Here are steps on how to set up and administer a VDR that’s intuitive, secure, and aligned with the goals of the deal.

1. Choose your VDR provider

Pick a platform that fits your security, usability, and budget needs. Use the tips provided above to make an informed decision.

2. Plan your folder structure

Before uploading the documents, organize them all into clearly labeled folders. Group them by category— like financials, legal, marketing, HR — so everything is easy to find.

3. Upload and label your files

Use the bulk upload feature to save time. Once uploaded, double-check if the documents are up to date, named clearly, and stored in the right folder.

4. Set user roles and access permissions

Decide who can see, edit, download, or share confidential documents. This helps protect sensitive data and ensures people only access what they need.

5. Invite users and track activity

Send invites to stakeholders and monitor who’s accessing what files. Most VDRs offer activity logs to keep file sharing transparent.

6. Use collaboration tools

Take advantage of built-in features like Q&A modules or commenting to streamline communication within the data room.

7. Keep it updated

As the deal or project progresses, regularly update the data room with new information or documents. If using an investor data room, a company might need to add updated financials, pitch decks, or KPIs as its fundraising efforts change.

This step-by-step guide on setting up a data room offers detailed guidelines for starting work with a virtual data room.

What information should be included in the data room?

When preparing a data room, especially for due diligence or business transactions, one should make sure this secure online space is well organized and includes a set of documents across key categories. The latter is essential for providing a full view of the company’s operations, financial status, legal standing, and other critical aspects. Here is the comprehensive list of key documents to include in a data room:

1. Corporate information

- Corporate structure chart

- Certificate of incorporation

- Bylaws and amendments

- Shareholder agreements

- Board meeting minutes

2. Financial statements

- Audited financial statements (last 3-5 years)

- Management accounts

- Cash flow projections

- Tax returns (last 3-5 years)

- Debt schedules and financial metrics

3. Legal documents

- Material contracts (customer, supplier, vendor agreements)

- Litigation history and current lawsuits

- Intellectual property documentation (patents, trademarks, licensing agreements)

- Regulatory filings, permits, and licenses

- Confidentiality and nondisclosure agreements

4. Human resources insights

- Employment agreements and contracts

- Employee handbook and HR policies

- Organizational charts

- Employee turnover and satisfaction reports

- Labor union agreements

5. Operations and commercial documents

- Standard operating procedures and quality control reports

- Supplier contracts and inventory records

- Market analysis reports and competitive analysis

- Customer lists and sales pipeline

- Product/service descriptions and strategic plans

6. IT and technology information

- IT systems overview and network architecture

- Cybersecurity policies and audit reports

- Software and hardware inventories

- Disaster recovery and data privacy policies

7. Assets

- Real estate deeds and leases

- Equipment leases and asset inventories

8. Risk management

- Insurance policies

- Environmental compliance reports

This is just an example of the documents to include. These can also be other confidential information, for example, operational plans and reports, or cap tables and pitch decks for informed investment decisions. The point is to share documents that the relevant stakeholders need to conduct a thorough evaluation, whether for mergers and acquisitions, fundraising, audits, or other business transactions.

Best virtual data room providers

Selecting an effective data room is a complex process that requires time and dedication to investigate the key market players, their features and pricing models. To make it a little bit easier for everyone looking for a reliable provider, here is the list of the top 5 VDRs. Each of these providers offers unique features tailored to specific business needs. For those who need a deeper dive into the VDR landscape, explore this comparison of the best data rooms in the UK.

| Provider | Best for | Key features | Security certifications | Pricing (starting) |

| Ideals | M&A, Due Diligence | – AI-powered document analytics – Granular permissions & watermarking – Intuitive UI + 24/7 support | ISO 27001, SOC 2, GDPR, HIPAA | Custom quote |

| Intralinks | Enterprise Deals | – Advanced workflow automation – AI-driven insights – Cross-border compliance tools | SOC 2, ISO 27001, FINRA | $25,000+/deal |

| Merrill Datasite | Large M&A, IPOs | – AI redaction – Drag-and-drop bulk uploads – Real-time reporting | ISO 27001, SOC 2, NIST 800-53 | $10,000+ |

| Firmex | Legal & Compliance | – Custom branding – Secure Q&A modules – Detailed audit logs | SOC 2, HIPAA, GDPR | $500/month |

| Box Virtual Data Room | Startups & Mid-Market | – Integrates with Salesforce, Slack – Unlimited storage (Enterprise tier) | SOC 2, FedRAMP, GDPR | $15/user/month |

FAQs

How is cloud storage different from a data room?

While both store files, VDRs offer advanced security, compliance, and deal-specific tools, unlike general cloud storage.

For how long should I leave my data room open?

It depends on the deal complexity. If it is a due diligence process during an M&A, for example, a data room may stay open until the deal closes. For internal use, some companies keep data rooms running continuously.

Do small businesses use data rooms?

Sure! Many VDR providers, like Ideals or Intralinks, offer scalable pricing plans for startups and SMBs.

How much does a data room cost?

Data room pricing varies greatly by provider, storage, and features. The costs can range from $100 to $1,000+ per month. The pricing models also differ; some providers charge per user or page, while others offer flat monthly rates and tailored pricing. Consider reaching out to VDR sales managers for a detailed quote analysis.